Survey: 70% of Firms in Favor of Raising the “¥1.03 Million Wall”

Economy Politics- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

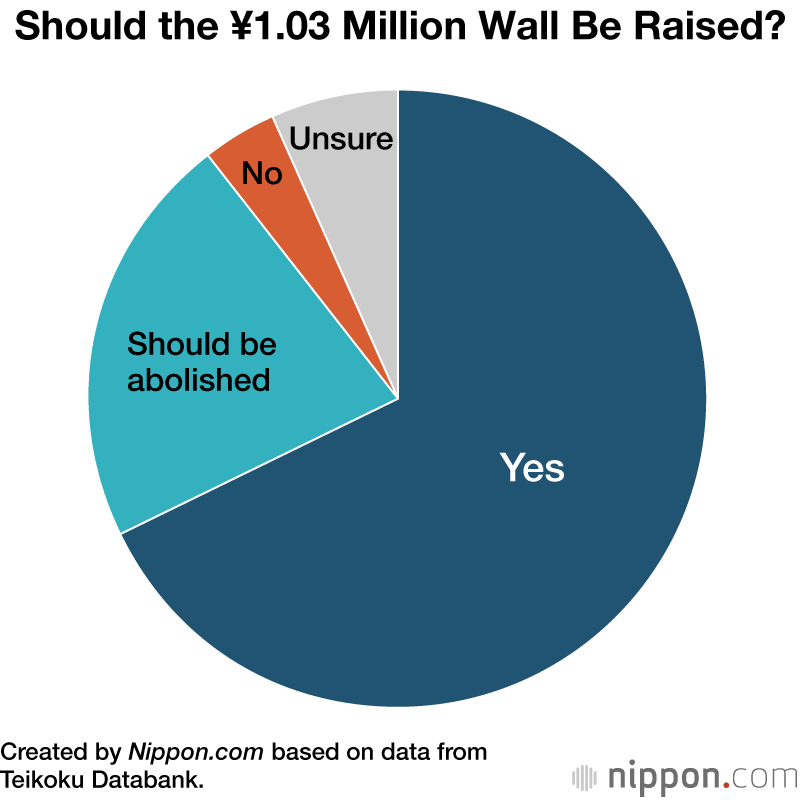

A Teikoku Databank survey carried out from November 8 to 12 revealed that 67.8% of the 1,691 companies that responded favored raising the so-called ¥1.03 million wall. When combined with the 21.9% of companies favoring the abolition of the wall itself, 90% of companies supported revision of the current situation.

When individuals’ annual income exceeds ¥1.03 million, they clear the limit for tax exemption and must pay an income tax and a resident tax. Some part-time workers curb their working hours so as not to exceed this “wall” and reduce their net income—a factor worsening the labor shortages experienced by companies. In the case of student part-time workers, income of ¥1.03 million is also the dividing line where their parents can no longer claim a dependent tax deduction.

The Democratic Party for the People has pledged in its campaign promises to raise the tax-exempt level of income from ¥1.03 million (the sum of the basic deduction and the earned income deduction) to ¥1.78 million so as to boost net income. This promise won the support of voters, and the DPP greatly increased its parliamentary seats in the October 27 House of Representatives election. The DPP has been negotiating the increase of the ¥1.03 million wall with the Liberal Democratic Party and the Komeitō, the ruling coalition parties. On November 22 the government announced a new economic package worth some ¥39 trillion to combat inflation; building on the interparty talks, it stated that fiscal 2025 tax system revisions would include discussion on and a raising of the ¥1.03 million wall.

The Teikoku Databank survey included such viewpoints as “Many part-time workers are aware of the ¥1.03 million wall and raising the wall higher would eliminate the curbing of working hours” (from a respondent in the restaurant industry); “Consumption will be stimulated through the tax-cut effect” (real estate); and “There is the impression that working comes with the loss of paying taxes. The ¥1.03 million wall is an old system and should be abolished” (information services).

To cover the loss of tax revenues, it will be necessary to secure financial resources or to reduce expenditures. In an estimate provided by Chief Cabinet Secretary Hayashi Yoshimasa, raising the ¥1.03 million wall would result in ¥7 trillion to ¥8 trillion in lost revenues. While a minority position, the Teikoku Databank survey also included the opposing viewpoint, “The shortage of financial resources may lead to higher taxes” (construction).

The Daiwa Institute of Research estimates that the tax-cut effect of increasing the basic deduction alone would favor high income earners and counter efforts to reduce income disparities.

Tax Reduction by Annual Income

| Annual income | Tax reduction |

|---|---|

| ¥2 million | ¥82,000 |

| ¥3 million | ¥113,000 |

| ¥5 million | ¥133,000 |

| ¥6 million | ¥152,000 |

| ¥8 million | ¥228,000 |

| ¥10 million | ¥228,000 |

Note: Expected reductions in tax bills if the basic deduction income level is hiked.

Source: Daiwa Institute of Research.

In terms of “walls” that kick in at certain levels of annual income, in addition to the ¥1.03 million wall, there are similar triggers at ¥1.06 million, ¥1.30 million, ¥1.50 million, and ¥2.01 million related to the special spousal deduction and to social insurance premiums.

(Originally published in Japanese. Banner photo © Pixta.)