Japanese Savers Change Mindset as Interest Rates Return

Economy Lifestyle Society- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

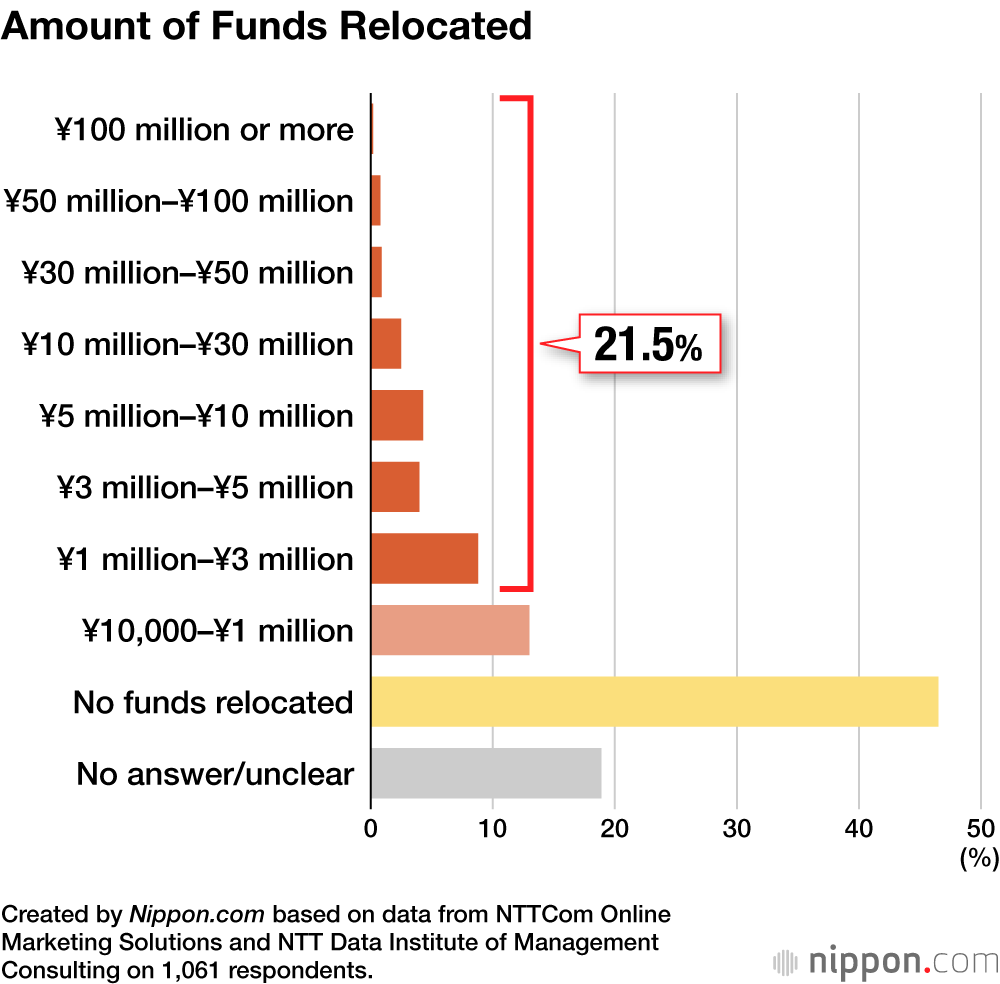

In March 2024, the Bank of Japan halted its policy of negative interest rates that had been in place for nearly eight years. A July 2025 survey on financial institution usage found that almost 35% of respondents said they had relocated their deposits within the past year, with 21.5% shifting at least ¥1 million in funds.

The nationwide survey was conducted by NTTCom Online Marketing Solutions in collaboration with NTT Data Institute of Management Consulting, targeting adults aged 18 or older. Survey responses were received from 1,061 people.

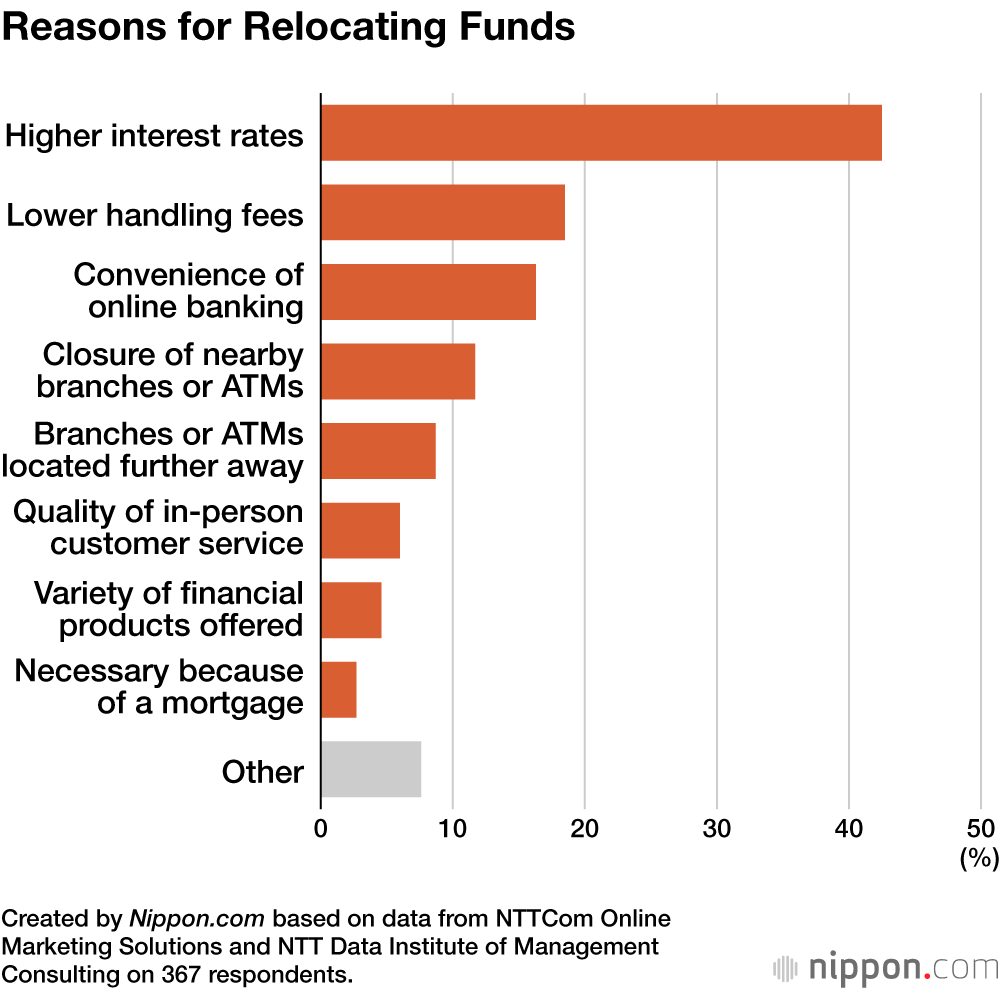

The top reason by far for relocating deposits, mentioned by 42.5% of respondents, was “higher interest rates.” This demonstrates a renewed sensitivity to interest rates, compared to the extended period when the negative interest rate policy was in place.

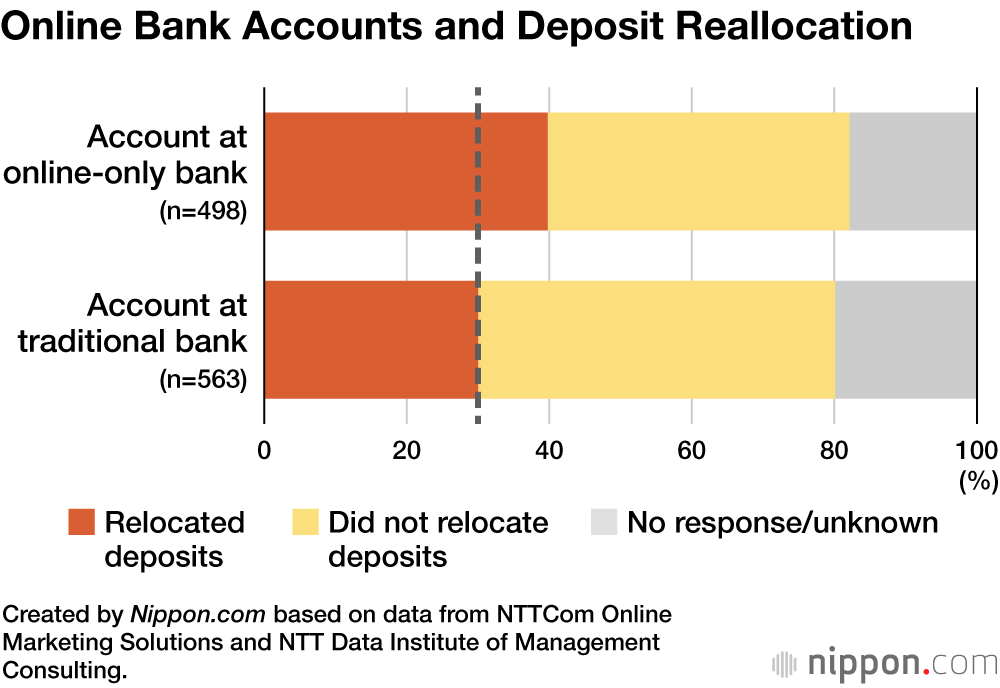

The survey also analyzed the relationship between holding an online-only bank account and the relocation of deposits, finding that the reallocation rate over the past year among who use online-only banks was around 9 to 10 percentage points higher than among those who do not.

The breakdown of those who relocated their deposits mainly due to a higher interest rate, elsewhere shows that the highest proportion, at 44.6%, was made up of those who only have an account at an online-only bank. But close behind, at 40%, were those with accounts at credit unions, regional banks, or megabanks, which suggest that all kinds of savers are becoming more conscious of interest rates.

Data Sources

- Survey on financial service usage trends (Japanese) from NTT Data Institute of Management Consulting.

(Translated from Japanese. Banner photo © Pixta.)