Heisei Blues: The Post-Bubble Struggles of Japan’s Financial Sector

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

The three decades of the Heisei era have had a debilitating impact on Japan’s banking sector, whose once-commanding clout dissipated as the bubble economy burst, resulting in a huge pile of nonperforming assets. There were 21 major financial institutions at the start of Heisei in January 1989, but many fell by the wayside, and repeated mergers among the remaining ones have shrunk the sector—at the era’s end—to just 3 megabanks and a handful of financial groups. Banks continue to be plagued by deflation, while monetary easing, which has kept interest rates low, has also depressed banks’ earnings.

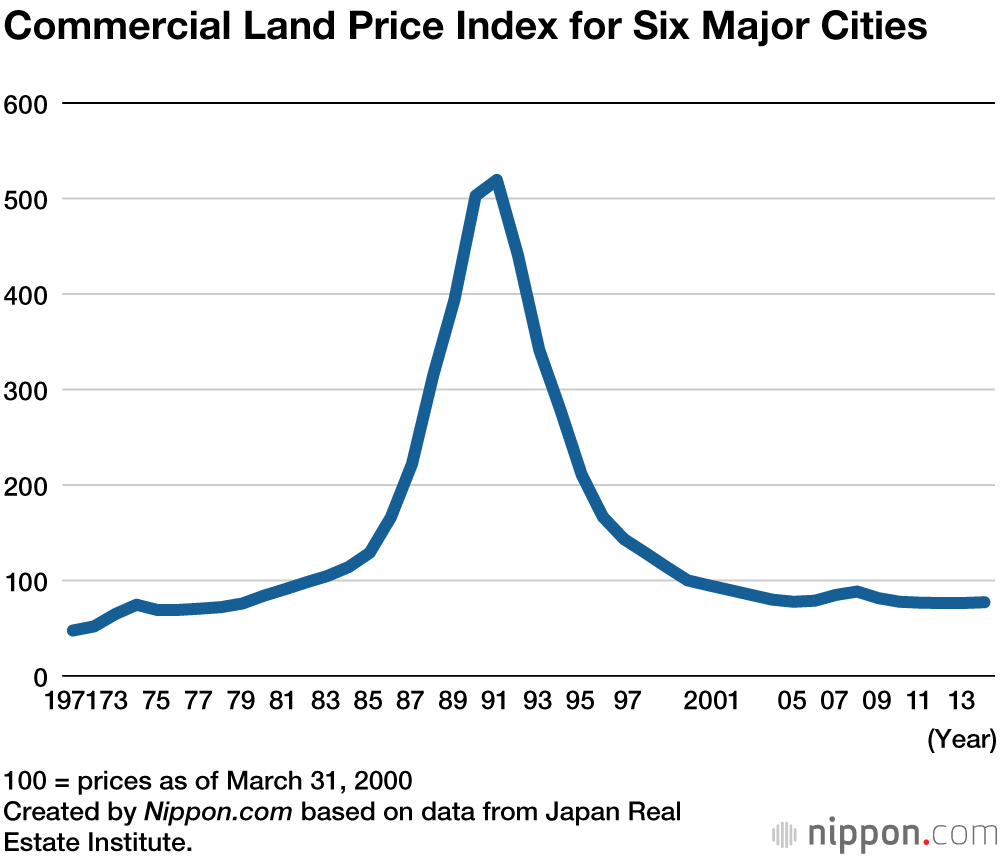

Tumbling Land Prices

On December 29, 1989, the Nikkei stock index reached an all-time high of 38,915, only to tumble to around half that level just nine months later on October 1, 1990, when it dipped below 20,000. The stock market bubble had collapsed, and land prices, too, would soon begin a rapid descent.

After reaching a peak in 1990, the price of commercial land continued to decline for 15 years; it was not until 2005 that prices registered an upturn. According to the Japan Real Estate Institute, the index of commercial land prices in six major cities (central Tokyo (23 municipalities), Yokohama, Nagoya, Kyoto, Osaka, and Kobe) fell by 87% from peak levels. The plunge was particularly staggering in 1992 and 1993, when the index fell by 15% and nearly 25%, respectively.

Both the duration and size of the decline were unprecedented in postwar Japan and shattered the long-held myth of ever-rising property prices. The banks that provided financing for speculation—both to other financial institutions and to real-estate developers—saw their loans turn sour when the bubble burst.

Real estate is typically used as collateral for bank loans; this means that when market value drops, the amount one can borrow may also decline. To borrow the same amount, one might need to provide additional security. As a result, the collapse of the land bubble was particularly painful for nonbank financial institutions and realtors, but other companies also suffered. A credit crunch coupled with poor business performance could readily short-circuit a company’s cash flow.

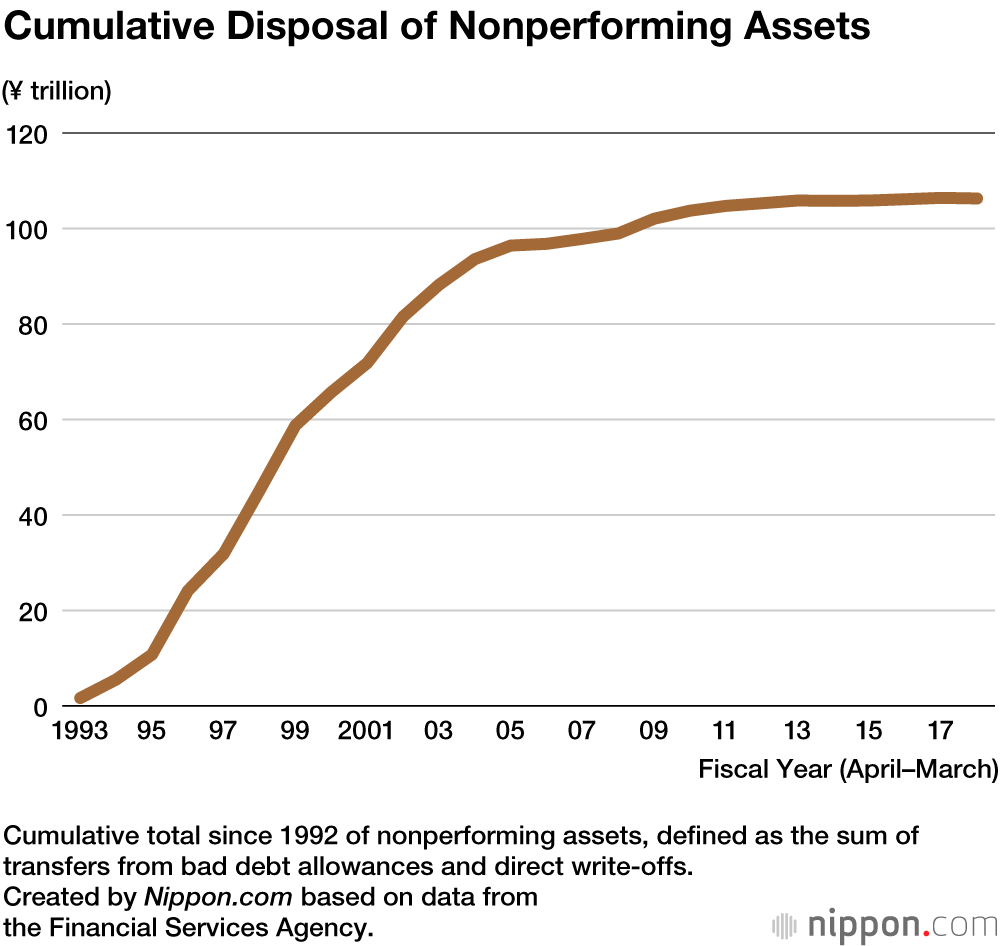

Writing Off ¥100 Trillion in Bad Loans

Deteriorating finances led to a plethora of bankruptcies, with total liabilities of failed companies jumping from just over ¥2 trillion in 1990 to ¥8 trillion the following year. The figure topped ¥10 trillion in 1997 and reached an all-time high of ¥24 trillion in 2000. While it edged downward thereafter, it continued to decimate the economy, remaining above ¥10 trillion through 2003.

The losses accruing from nonperforming loans were absorbed by banks’ accumulated earnings. Banks could also cash in on the unrealized capital gains of their shareholdings, whose market value was considerably higher than their book value. Such latent profits, though, eventually dried up; the total for the banking sector in 1990 was around ¥50 trillion but dwindled to ¥38 trillion the following year with the collapse of the stock market bubble and declined further to ¥20 trillion in 1992. By 1998, the figure was flat. Many banks were forced to sell their shares to help write off their bad loans, but this, ironically, further caused prices to fall. To prevent a downward spiral, the Bank of Japan in 2002 adopted an unusual policy of purchasing the shares held by private banks.

Banks held ¥8 trillion in nonperforming assets in 1992, soon after the bubble’s collapse. This swelled to ¥13 trillion in 1993 and ¥40 trillion in 1995 and eventually ballooned to ¥52 trillion in 2002. The ratio of nonperforming assets to total loans, too, hit a peak in 2002, reaching 8.6% (for all deposit-taking financial institutions). Upwards of ¥100 trillion—equivalent to 20% of Japan’s gross domestic product—in cumulative bad loans has been written off since the bubble’s collapse; this has obviously taken a heavy toll on the banking sector.

Restructuring of the Financial Sector

The task of disposing bad loans is an unrewarding task that depletes banks’ capital, leading to an excess of liabilities and, eventually, insolvency.

The table below lists the prominent bank failures during the Heisei era and the resulting realignment of the financial sector. Perhaps the most shocking—for those working in or supervising the industry—was the November 1997 failure of Hokkaidō Takushoku Bank and the shutdown of Yamaichi Securities, which were seen as portending a financial meltdown. Their collapse was precipitated by the bankruptcy of Sanyō Securities, which caused a severe contraction of the money market and touched off a series of failures, including, in 1998, of the Long-Term Credit Bank of Japan and the Nippon Credit Bank—both of which were nationalized—and of a spate of regional banks.

In an attempt to defray the cost of writing off bad debt, many banks chose to merge, pooling their resources to become bigger entities. The government encouraged such initiatives by creating a framework for the injection of public funds (through the expansion of the deposit insurance scheme), through which ¥13 trillion was provided to recapitalize struggling financial institutions. An additional ¥19 trillion was disbursed as grants, and ¥6 trillion in nonperforming assets were purchased—resulting in the expenditure of ¥38 trillion from the public coffers. Losses from special loans by the BOJ to Yamaichi Securities and Nippon Credit Bank reached an additional ¥200 billion.

A mechanism for the injection of public funds into the banking sector was not established until the collapse of the Long-Term Credit Bank in 1998—many years after the speculative bubbles burst. An indirect factor behind the delay was the tug-of-war between the commercial banks and those affiliated with Japan’s agricultural cooperatives, backed by farm-bloc politicians, over who should rescue seven struggling home mortgage lending institutions. The fray did not subside until December 1995, when the government decided to step in and pump ¥685 billion into these nonbanks.

But this decision drew angry protests from the public, which saw no reason why tax money should be used to salvage the private institutions; politicians thereafter became reluctant to channel public funds into the banking sector, and the Ministry of Finance was stripped of its oversight of the financial industry—that function being assigned to the newly independent Financial Services Agency.

The tardiness of Japan’s political leaders in salvaging the post-bubble financial chaos stands in stark contrast to the decision made by Washington to quickly spend $700 billion to bail out banks and financial institutions in the 2008 global economic crisis, which enabled not only the prompt revival of the financial sector but also the smooth recovery of government investments.

Low Interest Rates and Profit Margins

The bubble’s crash sent businesses scurrying to minimize their debt. Bank lending atrophied as a result, shrinking by more than 8% per year between 2002 and 2004. It was not until 2006 that bank loans returned to growth, coinciding with the halt in the decline of real estate prices. Tumbling demand for financing applied downward pressure on interest rates, which was further compounded by the BOJ’s expansionary monetary policy. This meant a further dwindling of profit margins for banks; according to the Japanese Bankers Association, the spread between interest rates earned through lending and those paid in procuring funds have fallen from 1.8% prior to the bubble’s collapse to just 0.2% today.

Lending money is one of banks’ key functions, so smaller spreads would naturally mean leaner business results. Japan’s megabanks have been able to offset shrinking profits at home by seeking investment opportunities abroad, but regional banks with domestic operations have had a hard time making ends meet. Indeed, 54 regional banks—half the national total—are reporting losses in their lending activities and in fees and commissions, some for consecutive years. Nonperforming assets are no longer a big issue for them, and credit risks are low. But should the economy take a downturn and push smaller companies out of business, these regional banks could be hit hard as loans become irrecoverable.

The financial sector may be on the cusp of a new, post-Heisei era of realignment. There is a nagging and uneasy sense of déjà vu hanging over the industry.

| Month, Year | Major Financial Events of the Heisei Era |

|---|---|

| December 1989 | Nikkei average registers an all-time high of 38,915 on December 29. |

| July 1991 | Tōhō Sōgo Bank becomes insolvent and becomes the first to receive assistance from the Deposit Insurance Corporation. |

| December 1994 | Two credit associations, Tokyo Kyōwa and Anzen, become insolvent. |

| December 1995 | The cabinet approves the injection of ¥685 billion into seven home loan institutions. |

| April 1996 | Mitsubishi Bank and the Bank of Tokyo merge to become the Bank of Tokyo-Mitsubishi. |

| November 1997 | Sanyō Securities, Hokkaidō Takushoku Bank, and Yamaichi Securities become insolvent. |

| March 1998 | Public funds of ¥1.8 trillion are injected into 21 major banks. |

| October 1998 | The Long-Term Credit Bank of Japan becomes insolvent. |

| December 1998 | The Nippon Credit Bank becomes insolvent. |

| December 1998 | The Financial Reconstruction Commission is launched. |

| January 1999 | The Chūō and Mitsui trust banks announce their merger into the Chūō Mitsui Trust and Banking Co. |

| March 1999 | Public funds of ¥7.5 trillion are injected into major banks. |

| August 1999 | The Industrial Bank of Japan, Dai-Ichi Kangyō Bank, and Fuji Bank announce their merger (renamed Mizuho Holdings in September 2000). |

| October 1999 | The Sumitomo and Sakura Banks merge (now called Sumitomo Mitsui Banking Corp.). |

| July 2000 | The Financial Services Agency is launched. |

| October 2000 | The Sanwa, Tōkai, and Tōyō Trust banks announce their merger (renamed UFJ Holdings in April 2001). |

| September 2001 | The Daiwa and Asahi Banks announce their merger (now Resona Bank). |

| October 2002 | Financial Services Minister Takenaka Heizō announces the Takenaka Plan for the disposal of nonperforming assets and revival of the financial sector. |

| July 2004 | The Bank of Tokyo-Mitsubishi and UFJ announce their merger (now MUFG Bank). |

| April 2005 | Full start of the “payoff” scheme, ending guarantees for the full amount of deposits in the case of a bankruptcy. |

| January 2006 | Postal services are privatized with the launch of Japan Post Holdings. |

| September 2008 | Lehman Brothers becomes insolvent, setting off a global financial crisis. |

| October 2008 | The Nikkei index falls to its Heisei low of 6,994. |

| September 2010 | The Incubator Bank of Japan becomes insolvent, and is the last bank failure to date. |

| March 2011 | The Great East Japan Earthquake rocks the Tohoku region. The European debt crisis sends the value of the yen spiraling to ¥75 to the dollar. |

| April 2012 | Sumitomo Trust and Banking, Chūō Mitsui Trust and Banking, and Chūō Mitsui Asset Trust and Banking merge to form Sumitomo Mitsui Trust Bank. |

| April 2013 | BOJ Governor Kuroda Haruhiko announces a policy of unprecedented monetary stimulus through expanded asset purchases. |

| April 2014 | The consumption tax is raised from 5% to 8%. |

(Originally published in Japanese on March 4, 2019. Banner photo: The last day of trading on the Tokyo Stock Exchange in 1989, when the Nikkei index hit an all-time high of 38,915. ©Jiji.)