Next Bubble to Arrive in Disguise?

Economy Society Lifestyle- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

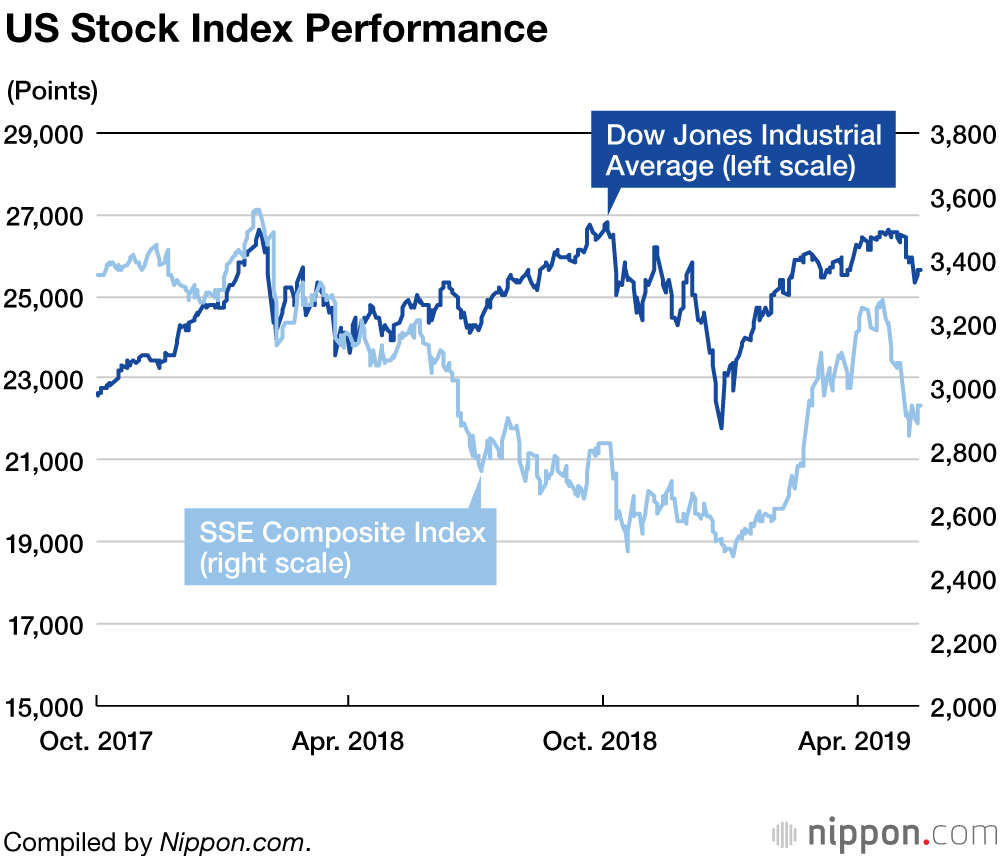

Share prices in New York began a sharp decline in October 2018, establishing a major bottom at the end of the year. Shares then rebounded rapidly when Federal Reserve Chairman Jerome Powell indicated a pause to interest-rate increases in January (Chart 1). Only two and half months were needed for shares to approach their October high. What distinguished this rebound was the decrease of the long-term interest rate in the United States. Both share prices and bond prices rose at the same time. After weakening momentarily, the US dollar rebounded in the foreign exchange market, as if reacting positively to higher share prices. The dollar appreciating while the long-term interest rate fell was an unusual sight. The result was a triple high, where stock prices, bond prices, and the dollar all rose together. This came to be viewed as a classical liquidity-driven rally, the consequence of the expansion of the supply of dollars.

In terms of its magnitude, the SSE Composite Index achieved a far larger rebound (Chart 1). After declining through 2018, the index bottomed out in January and surpassed 3,000 after about two months. China also eased its monetary policy in 2019, such as by reducing the reserve ratio.

Anticipating how a trade war would damage the real economy, both the United States and China eased monetary policy, out of expectation for the prompt impact this would have. Japanese shares have regained only half of their losses, recovering weakly from their slump toward the end of 2018. What is noteworthy, however, is that these reactions are not temporary and that they are compelling the Bank of Japan and the European Central Bank to revise their policies of normalizing interest rates. The damage of the trade war between the United States and China is expected to be prolonged, which will serve to further amplify excess liquidity on a global scale.

Prospects for the next bubble will be incubated by the central banks of Japan and Europe falling behind in extending the period of monetary easing or by their further easing of monetary policy. The continuation of a zero interest rate or a negative interest rate will promote investment in assets that do not pay interest, such as gold and virtual currencies. For example, when the interest paid on bonds becomes extremely low, the difference between them and gold, virtual currencies, and other non-interest-bearing assets will disappear. The expected rate of return on gold and virtual currencies will appear larger to the degree that capital gains can be anticipated. By encouraging leveraging, where large positions can be taken with small outlays, speculation will be easier to engage in.

Pressure on the BOJ to Ease Further

The repercussions of the US-China trade war will further delay the Bank of Japan’s strategy for exiting its present phase of ultra-easy monetary policy. Trade statistics for January and February revealed a decline in exports to China. While the lunar new year enabled exports to China to increase year on year in February, when January and February are taken together, it is quite clear that China’s economy is slowing.

In July 2018, the BOJ doubled the range of movement of the long-term interest rate from 0.1 percentage point around 0% to a range of 0.2 point around 0%, taking a step toward exiting from its extremely low interest-rate policy. The BOJ has a tendency to retreat cautiously from extreme monetary easing after waiting to see what the Federal Reserve Board and the European Central Bank do. Having analyzed its monetary policy over many years, I wonder with regret about whether the BOJ has failed repeatedly in normalizing interest rates. With a higher consumption tax approaching in October 2019, there is now the chance that the BOJ will ease further.

In January 2019, production-related economic statistics worsened across the board, and the Cabinet Office’s Index of Business Conditions began to signal the risk of a downturn. With a consumption tax increase pending in October, the government has been placed in an extremely difficult situation. In my reading, the Abe administration will not postpone the tax increase but will try to support the economy before and after the new tax rate kicks in, such as through additional economic policies. Thus, there is the possibility that the BOJ will ease further to reinforce the government’s actions.

The problem with this scenario is that the BOJ has run out of effective tools in its monetary toolbox. The central bank is pursuing a policy of yield curve control with the short-term interest rate at –0.1% and the long-term interest rate (10 years) at 0.0%. The BOJ is likely to reduce the short-term interest rate to –0.2% and to revise in some way its target for the long-term interest rate.

Another unusual policy can be considered. To increase loans to companies, the Bank of Japan could use its Loan Support Program to effectively subsidize banks that are actively extending loans. Specifically, this would be monetary easing where the BOJ supplies funds with a negative interest rate to banks with growing outstanding loans and where the BOJ pays the relevant interest to banks.

Funds Flow into Real Estate

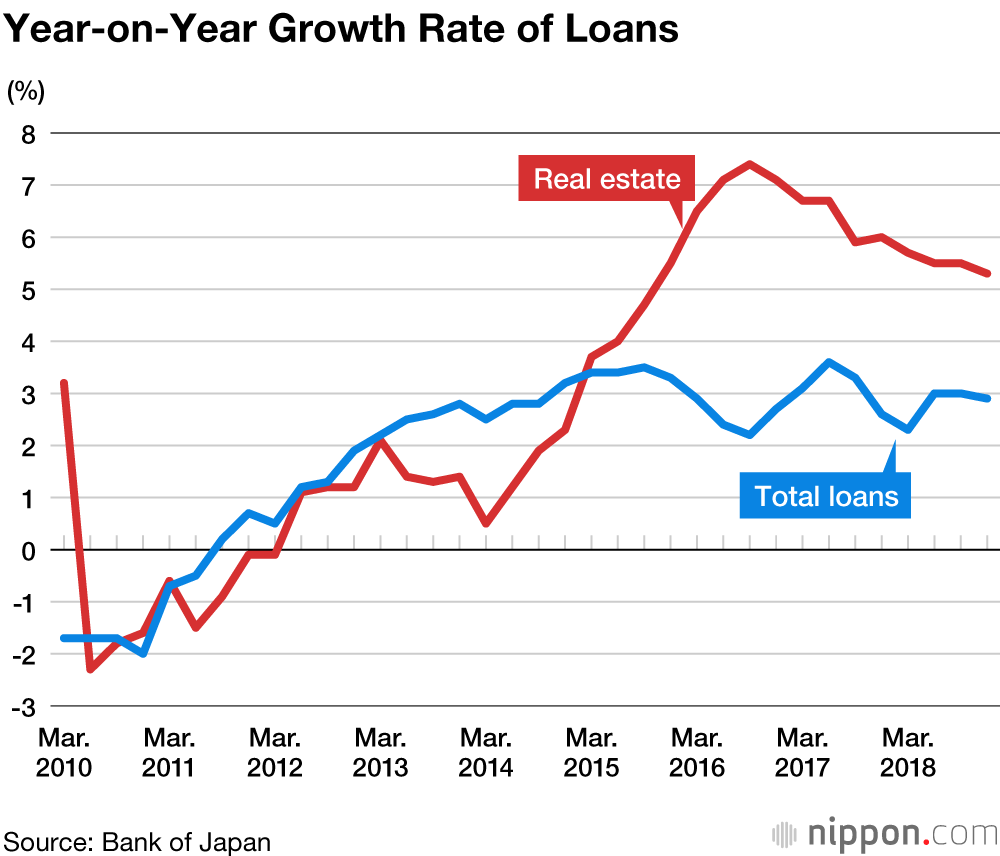

Loans that are likely to increase through such a program are real estate loans. Currently, of the new loans made to fund capital expenditures, 60% goes for real estate and housing loans to individuals. Real estate loans in outstanding loans grew 5.3% year on year as of the end of 2018 (overall growth rate of 2.9%, Chart 2).

Given the current ease with which vast quantities of funds can flow into real estate, land prices are rising, primarily in urban areas. In the Urban Land Price Index of the Japan Real Estate Institute, the index for commercial land had risen 8.1% year on year as of September 30, 2018. The increase of commercial land prices stands out in the land prices published by the government for 2019. What is noteworthy in particular is the accelerated rise of commercial land prices in such regional core cities as Sapporo, Sendai, Kyoto, Hiroshima, and Fukuoka. While such data do not necessarily indicate the return of a bubble, there are some properties in the collected data that point to such a possibility. What these developments suggest is that the real estate market has once again become a ready outlet for easy money.

A major theme in the real estate sector for the last few years has been the Tokyo Olympic Games, which will take place in the summer of 2020. The observation has been made for some time that land prices will plunge after the Olympic Games. More recently, however, the view is strengthening that, due to the redevelopment of urban centers under way, demand will not contract sharply just because the Olympic Games have ended. There are any number of redevelopment projects spanning 2019 to 2024 in such Tokyo areas as Shinagawa, Shibuya, Toranomon, Shinjuku, and Ōtemachi. It is no doubt true that the recent rise of real estate prices does not depend on the Olympic Games. For this reason, supported by vigorous demand, easy money will continue to flow into the real estate market, a situation ripe for overheating.

Booms in Forex, Virtual Currencies, and Art

Should a bubble reinflate, it will not be the same bubble as in the 1980s. Rather than occurring in regional economies, asset prices will surge locally in Tokyo and other major urban centers. This bubble will be both similar to and different from past bubbles in its form. I have described this as “a bubble with a different face.” Furthermore, when a local bubble does inflate, many expert commentators will take the convenient position of denying that this is happening. Such comments will have the effect of soothing ordinary peoples’ fear of bubbles.

Bitcoin soared in price toward the end of 2017. Many of the people buying Bitcoin were not Chinese or other overseas investors but Japanese investors. I have been aware that such virtual currencies as Bitcoin were popular among people in their twenties and thirties. The investment fever of young people began with day traders dealing in stocks through the Internet and spread to foreign exchange margin trading. What came next was investing in virtual currencies. It is possible that the next bubble will materialize at some other location in cyberspace.

The bubble fever of individuals has been growing in the last few years for apartment management and condominium investment. With the strengthening of the inheritance tax in 2015, interest has grown in inheritance tax strategies. The popularity for a period of investing in high-rise condominiums was driven by such strategies. Apartment management, however, has reached a point of excess. Despite the growth of vacant units, apartments and condominiums continue to be built. A number of scandals also came to light in 2018. Despite these developments, the heated interest of individuals in tax avoidance and inheritance tax strategies is unlikely to abate any time soon. The inflation of a mini-bubble in a sector people are overlooking would not come as a surprise.

An example that can be mentioned is changes in the art sector. The global art market is estimated to have grown 6% year on year to $67.4 billion (¥7,400 billion) in 2018 (according to a survey by Art Basel and the UBS Group), growth that is said to be the result of a global surplus of liquidity. In Japan, the rules for depreciating art were revised in 2015, making it possible to depreciate art whose purchase price is less than ¥1 million (formerly, less than ¥200,000). This expanded scope for expensing is likely to subtly influence peoples’ tax avoidance awareness through a greater tax avoidance effect and stimulate the buying and selling of art.

Going forward, it is expected that not only Japanese funds but US, Chinese, and other overseas funds as well will flow into Japan’s asset market to incubate prospective bubbles.

(Originally published in Japanese. Banner photo: the Bank of Japan Head Office in Nihonbashi, Tokyo. © Pixta.)

Bank of Japan monetary policy arts ECB Kuroda Haruhiko FRB cryptocurrency