A Bubbly Future for Japanese Brew

A Renaissance Is Brewing Among Japan’s Craft Beer Makers

Guideto Japan

Culture- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

On an unusually warm October day, beer brewers from across Japan set up their tents in an amusement park south of Tokyo. On offer were melon beers, brown-sugar beers, and soy-sauce beers. Visitors at the Yokohama Kanazawa Craft Beer and Gourmet Festa didn’t bat an eyelid.

For decades, Japanese beer meant only one thing: pilsner-style pale lagers made by the country’s handful of major brewers. But the market is changing rapidly today, and the change is being led by craft-beer makers keen to shake up the industry. New flavors and ingredients—including exotic elements like soba, miso, sweet potato, and Japanese pepper—are transforming the market, along with the regulatory changes. The result is more variety in both brews and drinkers.

Peaches and Melons

The 17 craft beer makers at the festival in Yokohama’s Hakkeijima Sea Paradise, an aquarium and theme park, hailed from beer-making hotspots like Tokyo and Kanagawa as well as far-flung prefectures like Okinawa, Okayama, and Kagawa. The latter was represented by mamemame brewery from Shōdoshima, an island in the Inland Sea famed for its olive plantations—and its soy sauce.

“This is a dry stout beer made in the imperial stout style,” says mamemame owner and founder Nakata Masaya, pouring a half-pint into a plastic glass. “We always use ingredients from Shōdoshima. This one has soy sauce that gives it richness, depth, and some bitterness.”

An Osaka native, Nakata spent time in the United States, where he was influenced by Brooklyn Brewery’s flagship beer, Brooklyn Lager. He cofounded mamemame in April 2017 as the sole beer brewery on Shōdoshima. Its other brews feature ingredients like strawberries, dekopon (a variety of mandarin orange), coriander seeds, rose geranium, and various herbs.

Colorful menus await at the Yokohama Kanazawa Craft Beer and Gourmet Festa. (© Tim Hornyak)

Colorful menus await at the Yokohama Kanazawa Craft Beer and Gourmet Festa. (© Tim Hornyak)

Another beer-lover experimenting with ingredients is Arai Shōichi, head brewer at local maker South Yokohama Craft Beer Laboratory. One brew they serve at events like the Yokohama Kanazawa beer festival is a New England IPA with a twist: it’s green and tastes like watermelon. It’s called Meron Sugiru Ēru, or Too Much Melon Ale.

“It’s popular at craft beer events because it’s so fruity,” says Arai. “This appeals to people who might not be used to drinking beer or can’t handle too much of it. They also love our peach-flavored beer.”

A cup of melon beer from South Yokohama Craft Beer Laboratory. (© Tim Hornyak)

A cup of melon beer from South Yokohama Craft Beer Laboratory. (© Tim Hornyak)

The Real Beer Revolution

Until this April, however, the brews made by Nakata and Arai were not beer under Japanese law. They were happōshu (quasi-beer), a tax category for liquor with low malt content compared to traditional beer or with ingredients that differ from the authorized lineup of malt, sugar, hops, rice, corn, sorghum, potato, and starch. On a typical 350-ml can of beer, which can cost about ¥200 to ¥300 yen, the government collects a whopping ¥77 in tax, but it’s only ¥47 for a can of happōshu. This has made it an appealing category for brewing companies looking to get products into the hands of price-conscious drinkers.

Often associated with cheap suds sold in convenience stores, the happōshu label has been slapped on everything from fruity European imported beer to domestically brewed products with less than 67% malt content. Since it’s cheaper than officially recognized beer, happōshu has a working-class credibility, but doesn’t hold much appeal for beer connoisseurs.

In 2018, however, the government overhauled the beer tax laws for the first time in 110 years, lowering the required malt content to 50%. It also allowed ingredients such as fruit, spices, seaweed, shellfish, and bonito flakes. Meanwhile, the taxes on beer, happōshu, and dai-san, the so-called “third-sector” no-malt beverages, which have the lowest taxes because they lack malt entirely, will be brought closer together.

Nakata’s and Arai’s brews are now officially beer.

“The craft beer industry is heating up,” says Arai. “It’s important not only to improve quality and taste but to have more beer with Japanese characteristics, and not just products inspired by beer in America and Germany.”

A Shifting Market

Japan’s craft beer boom is nothing new. In 1994, Japan relaxed the minimum brewing volume requirements for licensing, sparking an explosion in so-called ji-bīru, or microbrews. Hundreds of microbreweries appeared seemingly overnight. Dozens later shut down, often because their products were of poor quality, launched in part to lure visitors to hot springs and other tourist spots with catchy local labels and names and nothing in the way of brewing expertise to back them up. Today, though, there’s a greater emphasis on quality, experimentation, and food pairings. Kurafuto bīru, or “craft beer,” has largely replaced the term ji-bīru, and new breweries and brewpubs are continuing to open every month. There are now more than 300 craft beer makers across Japan, controlling about 2% of the domestic market.

According to Tokyo Shōkō Research, major craft beer makers saw sales rise 1% in January to August 2018 over the same period a year earlier. That’s a modest gain, but things aren’t rosy at all at Japan’s major brewers. Sales of beer, happōshu, and third-sector no-malt beverages by Asahi, Sapporo, Kirin, Suntory, and Orion fell by 3.6% in the first six months of this year compared to the same period in 2017; it was a record low for the sixth consecutive half-year period.

It’s no wonder, then, that Japan’s big brewers have been increasing their presence in the craft beer scene with new brews, brewpubs, and even craft beer subsidiaries. In 2015, for instance, Kirin launched Spring Valley Brewery, a wholly owned subsidiary that opened brewpubs in Yokohama, Kyoto, and Tokyo’s fashionable Daikanyama district.

Spring Valley Brewery’s Beer to Go craft beer counter opened in Tokyo’s Ginza Sony Park in August 2018. © Tim Hornyak

Spring Valley Brewery’s Beer to Go craft beer counter opened in Tokyo’s Ginza Sony Park in August 2018. © Tim Hornyak

In August 2018, Spring Valley Brewery opened Beer to Go, a deli and beer counter in Ginza Sony Park, an underground complex on the site of Sony’s former Ginza building. Beer to Go has the feel of a fast-food outlet, but it’s aimed at office workers looking for something other than the standard izakaya drinking experience. The shop has about than 10 craft beers on tap, including Daydream, a “Japanese white” with hints of yuzu citrus and Japanese sanshō pepper, as well as Jazzberry, a fruit beer made with raspberry juice. The beers are still categorized as happōshu because they have more than 5% nonstandard ingredients, but that doesn’t seem to be an issue for local workers lining up for brews to go with their mini-hamburgers, salads, and fries.

“The recent tax changes in Japan are a great opportunity to make beer more fun,” says Suzuki Yūsuke, marketing manager for Spring Valley Brewery. “Japanese tend to think of beer as only being yellow, bubbly, and chilled—a typical pilsner. But craft beer doesn’t have to be like that. Now is a great time to discover the many varieties and flavors in Japanese craft beer.”

A flight of craft beer at Spring Valley Brewery’s Beer to Go. (© Tim Hornyak)

A flight of craft beer at Spring Valley Brewery’s Beer to Go. (© Tim Hornyak)

The Quest for Japanese-Style Suds

Japan’s largest craft beer maker, Yoho Brewing, welcomes the tax changes. The lobby in its brewery in Saku, near Karuizawa, Nagano Prefecture, is redolent with the warm aroma of malt. In a laboratory-style room, workers conduct quality checks with sophisticated equipment. But they’re also experimenting with new brews created from Japanese ingredients and fruits. To coincide with the new tax rules, Yoho launched Sorry Umami IPA, a previously limited-edition beer featuring umami extracts from katsuobushi bonito flakes.

Founded in Nagano Prefecture in 1996 by Hoshino Resorts and now one-third owned by Kirin, Yoho Brewing operates a number of taprooms in Tokyo. Its brews are distributed throughout Japan and in about 10 other countries.

Yoho Brewing spokesperson Hara Kentarō explains the company’s approach to craft beer. (© Kawamoto Seiya)

Yoho Brewing spokesperson Hara Kentarō explains the company’s approach to craft beer. (© Kawamoto Seiya)

Yoho’s most popular product is Yona Yona Ale, an American Pale Ale introduced with pronounced citrus, and Aooni (“Blue Demon”), an India pale ale. Another of its offerings, however, is an example of how the new tax rules can still make it tough to meet Japan’s official standards for beer. Launched in 2012, Suiyōbi no Neko is a Belgian white-style with 99% malt content; the name translates as “Wednesday Cat” and is meant to appeal to women in need of a midweek tonic. It was classified as happōshu because of its orange peel and coriander seed flavorings, and remains so due to an ingredient used to control the beverage’s clarity. Despite this status, it’s taxed like beer because of its malt content. But the company isn’t overly concerned about that.

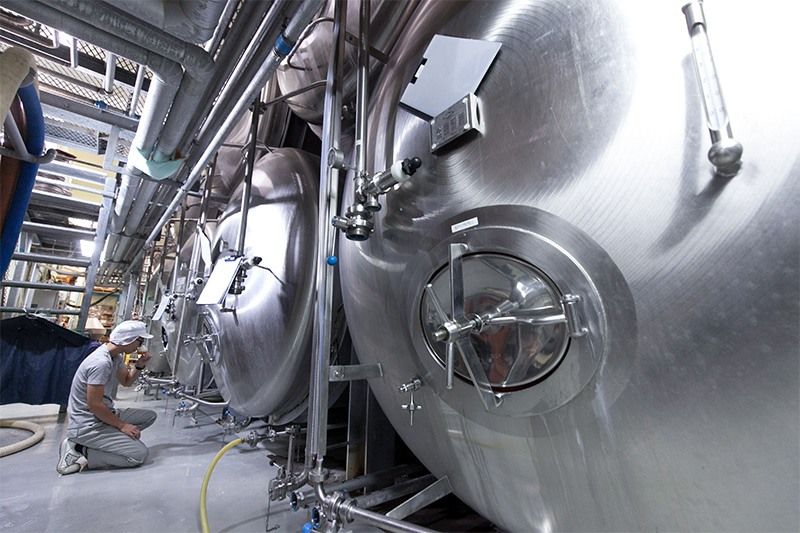

A brewer checks a sample at Yoho Brewing’s brewery in Saku, Nagano Prefecture. (© Kawamoto Seiya)

A brewer checks a sample at Yoho Brewing’s brewery in Saku, Nagano Prefecture. (© Kawamoto Seiya)

“Whatever it’s classified as, we’re making craft beer,” says Hara Kentarō, spokesperson for Yoho Brewing. “Even though lager is great beer, we aim to enrich the Japanese market by producing a variety of beers with distinct personalities. That’s our mission as a craft beer maker.”

Yoho Brewing’s Tokyo Black porter, Aooni IPA, Yona Yona Ale, Karuizawa Kōgen Beer Brown Ale, and Suiyōbi no Neko Belgian white. (© Kawamoto Seiya)

Yoho Brewing’s Tokyo Black porter, Aooni IPA, Yona Yona Ale, Karuizawa Kōgen Beer Brown Ale, and Suiyōbi no Neko Belgian white. (© Kawamoto Seiya)